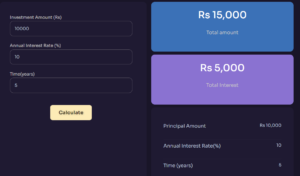

Rs. 0.00

Total amount

Rs. 0.00

Total Interest

Principal Amount

Annual Interest Rate(%)

Time (years)

A simple interest rate is a way of computing the interest accrued on a borrowed sum for a specific duration at a predetermined interest rate. The calculation involves multiplying three key factors: the principal amount, the interest rate, and the period.

Simple interest is a method of calculating interest on a fixed principal amount over a specified time frame. It applies to savings accounts, where banks pay interest on deposits, and loans, where borrowers pay interest based solely on the original principal. Unlike compound interest, the principal remains constant throughout the calculation.

How to Calculate Simple Interest Rate?

What are the terms used in the Simple Interest Formula?

Principal (P): The initial amount of money invested or borrowed.

Rate of Interest (R): The percentage of the principal charged as interest over a specific period.

Time (T): The duration for which the money is invested or borrowed, typically measured in years.

Interest (I): The amount of money earned or paid on the principal over the period, calculated using the formula.

Total Amount (A): The sum of the principal and interest at the end of the period.

Simple Interest Formula

The formula for simple interest is:

Simple Interest = 𝑃 × 𝑟 × 𝑡

Where,

𝑃 = P is the principal amount (the initial amount of money),

𝑟 = r is the annual interest rate (in decimal form),

𝑡 = t is the time the money is invested or borrowed for, in years.

Benefits of Simple Interest

© 2024 Copyright Eksikka. All Rights Reserved. Developed By Webtech Nepal